Electric cars have yet to catch on with American car buyers, but a new battery coming out of Massachusetts could make electric cars better and cheaper.

Electric cars have yet to catch on with American car buyers, but a new battery coming out of Massachusetts could make electric cars better and cheaper.

The Nanophosphate EXT is a lithium ion battery that can handle a wide range of extreme temperatures. Most electric car batteries cannot handle these temperatures, so electric cars have to be equipped with heating or cooling systems. According to a press release from the battery’s producers A123 Systems, these batteries can “significantly reduce or eliminate the need for heating or cooling systems, which is expected to create sizable new opportunities within the transportation and telecommunications markets, among others.”

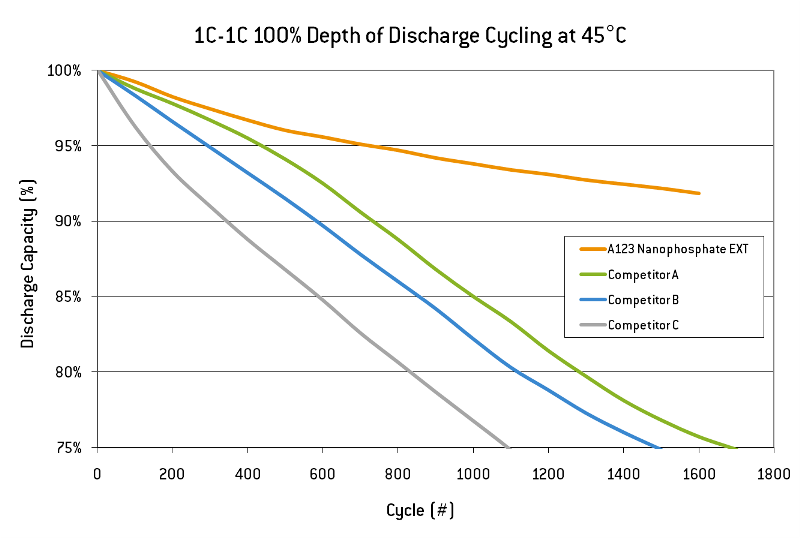

Additionally, the new battery lasts much longer than other batteries currently on the market. This chart shows how the A123 Nanophosphate EXT compares to competing batteries. After 1700 cycles at 45° C, all three competing brands have dropped to below 75 percent discharging capacity while the A123 Nanophosphate EXT hovers around 93 percent capacity.

With longer lasting batteries that can take the heat and cold, electric cars can be more affordable and more powerful with lower maintenance costs. Consumers that have written off the electric car could be convinced to give it a second look. At any rate, it is a huge leap forward in electric car technology and very promising for the future of automotive.

Low-cost electric cars are still a ways off, but Approved Loan Store can help you get into an affordable car today! Fill out our secure online auto loan application here, and keep up with the latest auto news by liking Approved Loan Store on Facebook and following Approved Loan Store on Twitter.

Car Talk fans were saddened to hear last week that hosts Tom Magliozzi and Ray Magliozzi will

Car Talk fans were saddened to hear last week that hosts Tom Magliozzi and Ray Magliozzi will  Jalopnik’s weird car listings from Craigslist are always good for a laugh, and yesterday’s bizarre

Jalopnik’s weird car listings from Craigslist are always good for a laugh, and yesterday’s bizarre  Recent reports from Edmunds.com indicate what we have seen first-hand over at Approved Loan Store, which is that car shoppers are eager to buy in 2012.

Recent reports from Edmunds.com indicate what we have seen first-hand over at Approved Loan Store, which is that car shoppers are eager to buy in 2012. One of the biggest reasons why consumers have poor credit is because of lackluster financial education and the spread of misinformation regarding how credit scores are calculated. A major misconception is about auto loans and how they can improve or hurt a person’s credit score, and we would like to clear that up today.

One of the biggest reasons why consumers have poor credit is because of lackluster financial education and the spread of misinformation regarding how credit scores are calculated. A major misconception is about auto loans and how they can improve or hurt a person’s credit score, and we would like to clear that up today. Car shoppers who have held off on buying so far this year should strongly consider buying in June.

Car shoppers who have held off on buying so far this year should strongly consider buying in June. At Approved Loan Store, we are always on the look-out for ways for our readers to save money on their new or used car. Oftentimes, though, we focus too much on the initial purchase of the car and don’t consider other long-term expenses associated with that car like

At Approved Loan Store, we are always on the look-out for ways for our readers to save money on their new or used car. Oftentimes, though, we focus too much on the initial purchase of the car and don’t consider other long-term expenses associated with that car like  As the country continues to recover economically, lenders are wooing consumers with

As the country continues to recover economically, lenders are wooing consumers with  Approved Loan Store loves bad credit. That’s our slogan because we work specifically with people struggling due to a low credit score. There’s a common belief that because you have bad credit means that you can’t get yourself a car loan. This couldn’t be further from the truth. We aim to make sure that not only are you able to get that loan, but that you have the education necessary for making a good decision.

Approved Loan Store loves bad credit. That’s our slogan because we work specifically with people struggling due to a low credit score. There’s a common belief that because you have bad credit means that you can’t get yourself a car loan. This couldn’t be further from the truth. We aim to make sure that not only are you able to get that loan, but that you have the education necessary for making a good decision. Earlier this month,

Earlier this month,