A question that has been plaguing car owners since the invention of the automobile is when to repair the car you own and when to get a new car. It isn’t an easy question to answer, but a recent article from the Christian Science Monitor attempted to shed some light on the subject.

A question that has been plaguing car owners since the invention of the automobile is when to repair the car you own and when to get a new car. It isn’t an easy question to answer, but a recent article from the Christian Science Monitor attempted to shed some light on the subject.

Some people would argue that you could keep repairing a car over and over again until the wheels fall off and could still save money over buying a new car. Those people are wrong, and even if you could find a way to save some money with numerous repairs, all you are doing is delaying the inevitable. By the time you finally trade in, the car you are trading in won’t be worth nearly as much, and you will have sunk hundreds or thousands of dollars into a car that doesn’t properly run.

Christian Science Monitor also points out that having an unreliable car could cause other problems. What if your car breaks down on the way to work? Can you get to work by public transit until you are able to get a new car? There is a good reason why car ownership has been strongly tied to employment status. Car owners don’t have to rely on public transit, so they have more employment options available to them, and they are more likely to be reliable and prompt.

Are you done sinking money into an unreliable car? Approved Loan Store can help you with your trade-in and new car purchase! Whether if you have good credit, bad credit, or no credit, we will work hard to get you a great new car at terms you can afford! Get started by filling out our secure online auto loan application here, and for more auto news and buying tips, like Approved Loan Store on Facebook, follow Approved Loan Store on Twitter, and subscribe to Approved Loan Store on YouTube!

Image courtesy of supakitmod / FreeDigitalPhotos.net

In the last few years, Kia has been making a concerted effort to appeal to a wider range of drivers. Besides vehicle value, they want to offer minivans, crossovers, and fuel-efficient compacts as well. Next month at the Chicago Auto Show, Kia will be unveiling its latest endeavor into luxury with their concept car, the Kia Cross GT.

In the last few years, Kia has been making a concerted effort to appeal to a wider range of drivers. Besides vehicle value, they want to offer minivans, crossovers, and fuel-efficient compacts as well. Next month at the Chicago Auto Show, Kia will be unveiling its latest endeavor into luxury with their concept car, the Kia Cross GT. As cabin fever sets in, drivers are itching for spring and the freedom of the open road. For many drivers, the perfect car for a joy ride is a convertible, and now during the winter months, dealerships want to give car shoppers an incentive to spring for their dream convertible.

As cabin fever sets in, drivers are itching for spring and the freedom of the open road. For many drivers, the perfect car for a joy ride is a convertible, and now during the winter months, dealerships want to give car shoppers an incentive to spring for their dream convertible. As 2013 kicks into gear with

As 2013 kicks into gear with  At

At  Distracted driving is a huge problem in this country. A driving distraction used to be squirming kids fighting over a Game Boy in the backseat, and now drivers have to block out smart phones, music, and even some of the technology built into the car like GPS and internet access. Every car company has an idea about how to curb distracted driving from hands-free calling to

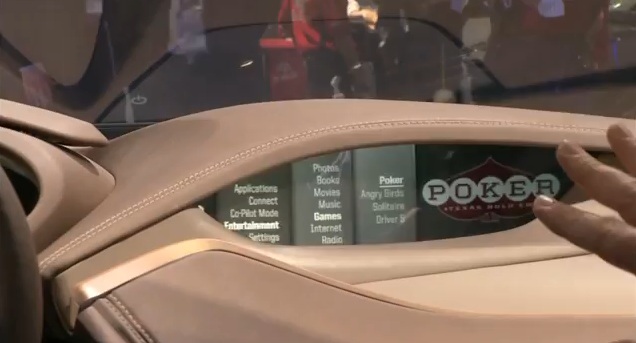

Distracted driving is a huge problem in this country. A driving distraction used to be squirming kids fighting over a Game Boy in the backseat, and now drivers have to block out smart phones, music, and even some of the technology built into the car like GPS and internet access. Every car company has an idea about how to curb distracted driving from hands-free calling to  2012 was an amazing year for the auto industry. Sales were so strong in 2012 that it would be completely understandable if the industry saw a slight dip in the beginning of 2013. To combat any drop off in sales, they are offering some of the

2012 was an amazing year for the auto industry. Sales were so strong in 2012 that it would be completely understandable if the industry saw a slight dip in the beginning of 2013. To combat any drop off in sales, they are offering some of the  At the Approved Loan Store, we work with people every day who have good credit, bad credit, and no credit alike. We understand that there are many people who have a low credit score but that they might have nothing to do with it. They could have been a victim of identity theft or maybe they agreed to co-sign on a loan and the other person skipped out on their payments. We thought we had heard it all until this story from the

At the Approved Loan Store, we work with people every day who have good credit, bad credit, and no credit alike. We understand that there are many people who have a low credit score but that they might have nothing to do with it. They could have been a victim of identity theft or maybe they agreed to co-sign on a loan and the other person skipped out on their payments. We thought we had heard it all until this story from the  Sometimes on a slow news day, news sites like to trot out silly fluff pieces like “How Clean Is Your Purse?” and “What Your Toothpaste Brand Says About Your Love Life.” We at Approved Loan Store had a good laugh, though, when we saw this headline,

Sometimes on a slow news day, news sites like to trot out silly fluff pieces like “How Clean Is Your Purse?” and “What Your Toothpaste Brand Says About Your Love Life.” We at Approved Loan Store had a good laugh, though, when we saw this headline,  Last year all across the country, car shoppers with subprime credit

Last year all across the country, car shoppers with subprime credit