What does it take to make a $700 1995 Pontiac Grand Am into one of the most wanted cars on the internet? Simply make the greatest Craigslist ad ever.

What does it take to make a $700 1995 Pontiac Grand Am into one of the most wanted cars on the internet? Simply make the greatest Craigslist ad ever.

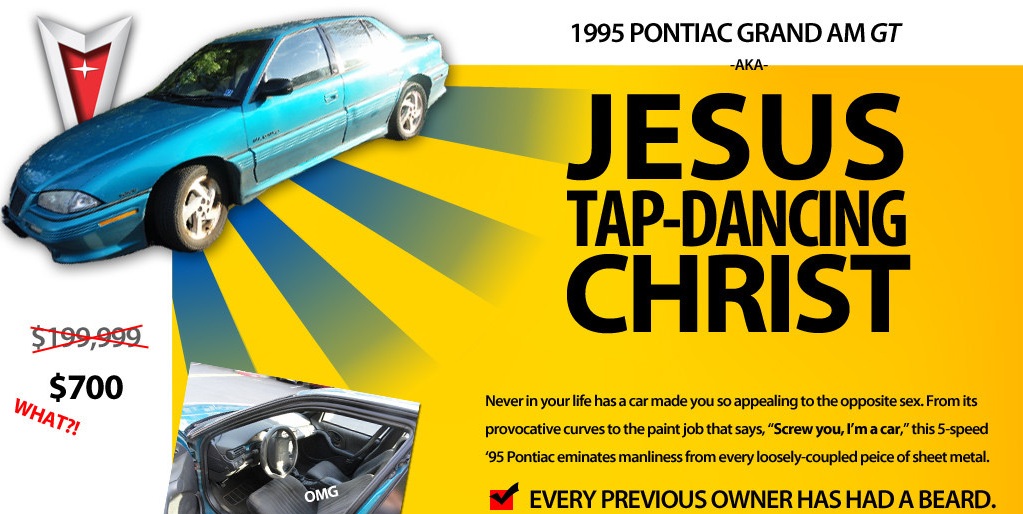

On Wednesday, Jalopnik posted what they claimed was “the best Craigslist car ad ever.” The ad, posted by Joe Strachila, was for a 1995 Pontiac Grand Am GT, a fairly run-of-the-mill used car. The ad, created by Joe’s lifelong friend Kyle Miller, was anything but ordinary.

I thought I had seen just about everything on the internet until I saw the ad’s headline, “1995 Pontiac Grand Am GT – AKA – JESUS TAP-DANCING CHRIST.” The splashy bright-yellow and blue ad claims, “Never in your life has a car made you so appealing to the opposite sex…EVERY PREVIOUS OWNER HAS HAD A BEARD. This was the car that broke Pontiac. When it came off the production line, each person in the company had a collective aneurysm from the visual masterpiece with which they had blessed humanity, and gave up entirely.”

Of course, the question I had was that if the car was so amazing, why was the owner selling it? The answer was that he wasn’t man enough to handle it. “I tried to be,” he laments.” “I grew my beard to unreasonable lengths, trimmed my fingernails with belt sander, ate nothing but lumber for 6 straight days and knocked a polar bear unconscious. The car chuckled at my failed attempt at manliness, and became so bloated with testosterone that it literally blew a head gasket. Oh right, you’re definitely going to have to fix that…”

I seriously doubt that any car, much less a car with a blown head gasket, could live up to the hype of this Craigslist ad. Still, I have to give the seller credit for creativity. He took a $700 1995 Pontiac Grand Am and turned it into an internet sensation, and now, he is flooded with offers for the car. Supposedly someone even offered $10,000 for the honor of owning “Jesus Tap-Dancing Christ.”

Only one person can get Joe’s 1995 Pontiac Grand Am, but if you’re looking for a car that will blow your mind even if you don’t have mind-blowing credit, Approved Loan Store can help! Fill out an auto loan application here, and keep up with the latest in auto news by liking Approved Loan Store on Facebook and following Approved Loan Store on Twitter.

The Consumer Financial Protection Bureau is still getting its feet wet seeing as how the President just assigned Richard Cordray to the agency a few months ago. That doesn’t mean they don’t want to hit the ground running, though.

The Consumer Financial Protection Bureau is still getting its feet wet seeing as how the President just assigned Richard Cordray to the agency a few months ago. That doesn’t mean they don’t want to hit the ground running, though. At Approved Loan Store, we get asked all the time why we can’t give car loan approvals over the phone and why our customers need to bring their driver’s license, Social Security card, proof of income, and other identification to their appointment. Yesterday, there was a perfect

At Approved Loan Store, we get asked all the time why we can’t give car loan approvals over the phone and why our customers need to bring their driver’s license, Social Security card, proof of income, and other identification to their appointment. Yesterday, there was a perfect  At Approved Loan Store, we take the hassle out of car buying. We make the process easy, even if you have challenged credit. Still, we want our customers to understand our process and why we are the best way to get into a new or used car quickly!

At Approved Loan Store, we take the hassle out of car buying. We make the process easy, even if you have challenged credit. Still, we want our customers to understand our process and why we are the best way to get into a new or used car quickly! These days, a lot of companies are promising the world to people with challenged credit who are looking for a way back. One of the fastest ways to re-establish credit is through a car loan, so there is a high demand for car loans from people with challenged credit. Unfortunately, this means that some businesses will take advantage of that demand and take advantage of less-informed consumers. We wanted to clear up some misconceptions and misinformation that is spread about credit restoration and auto loans. If more consumers are educated, then less people will fall prey to these predatory companies.

These days, a lot of companies are promising the world to people with challenged credit who are looking for a way back. One of the fastest ways to re-establish credit is through a car loan, so there is a high demand for car loans from people with challenged credit. Unfortunately, this means that some businesses will take advantage of that demand and take advantage of less-informed consumers. We wanted to clear up some misconceptions and misinformation that is spread about credit restoration and auto loans. If more consumers are educated, then less people will fall prey to these predatory companies. You go into a dealership and they set you up with car that you want. You sit down with the man in charge of finances and he gets you set up with a great deal. Everything is looking great and the dealership even lets you drive home with car even though the sale hasn’t been finalized. You get home and can’t help but smile at your good fortune. The house of cards doesn’t crumble until the next day, when the dealership calls to have you come back in. Suddenly the financing that you were offered has fallen through and now you’re being asked to sign a new deal with a higher interest rate or a much higher required down payment.

You go into a dealership and they set you up with car that you want. You sit down with the man in charge of finances and he gets you set up with a great deal. Everything is looking great and the dealership even lets you drive home with car even though the sale hasn’t been finalized. You get home and can’t help but smile at your good fortune. The house of cards doesn’t crumble until the next day, when the dealership calls to have you come back in. Suddenly the financing that you were offered has fallen through and now you’re being asked to sign a new deal with a higher interest rate or a much higher required down payment. This week, Approved Loan Store hit a major milestone. We got our 100th customer testimonial, posted right here on ApprovedLoanStore.com!

This week, Approved Loan Store hit a major milestone. We got our 100th customer testimonial, posted right here on ApprovedLoanStore.com! Scam artists are always looking for new ways to pull the wool over people’s eyes. One such case is a new fraud scheme that’s targeting car owners who are having troubles with car loans. It’s very similar to a scheme that was running rampant during the peak of the housing crisis where a company would offer assistance to struggling homeowners in securing a modification on their loan. They would collect up front fees from the unknowing victim and run with the money.

Scam artists are always looking for new ways to pull the wool over people’s eyes. One such case is a new fraud scheme that’s targeting car owners who are having troubles with car loans. It’s very similar to a scheme that was running rampant during the peak of the housing crisis where a company would offer assistance to struggling homeowners in securing a modification on their loan. They would collect up front fees from the unknowing victim and run with the money. In the midst of the partisan bickering in Washington D.C. over the budget recently, the auto industry has been

In the midst of the partisan bickering in Washington D.C. over the budget recently, the auto industry has been  With U.S. auto sales on the rise,

With U.S. auto sales on the rise,