At Approved Loan Store, we take the hassle out of car buying. We make the process easy, even if you have challenged credit. Still, we want our customers to understand our process and why we are the best way to get into a new or used car quickly!

At Approved Loan Store, we take the hassle out of car buying. We make the process easy, even if you have challenged credit. Still, we want our customers to understand our process and why we are the best way to get into a new or used car quickly!

The first step is filling out our convenient and secure online auto loan application here. Once you fill it out, you will hear back from one of our friendly Approved Loan Store representatives within 24 to 48 hours. They will verify the information on your application and let you know if you are picked for our loan program. If you are chosen, you will be scheduled to meet with an Approved Loan Store Special Finance Representative to look at vehicles and discuss your financing options.

Now, we get more questions about the meeting with a Special Finance Representative than any other part of the process, so we wanted to answer some of the more frequently asked questions here.

1. What do I need to bring with me to the appointment?

Bring your driver’s license, Social Security Card, a proof of residence, and proof of your income. Proof of residence can be a utility bill or bank statement that has your current address on it. For proof of income, bring two recent pay stubs or a letter from your employer stating how much you make and whether you are paid weekly or bi-weekly.

2. Do I need to buy a car if I set up an appointment?

Absolutely not! Approved Loan Store will work very hard to put together the best deal for you, but you are not obligated to purchase a vehicle if you meet with a Special Finance Representative.

3. Approved Loan Store set me up with Special Finance Representative located at a Kia/Chrysler/Mazda dealership, but I want a different brand of car. What do I do?

No worries! Your Special Finance Representative might be located at one dealership, but they can pull cars from any of Approved Loan Store’s certified locations. You are not limited by brand make or model. Tell your Special Finance Representative what car you are looking for, and they will do their best to get you that car! Remember, any make, any model!

4. Why do I need to set up an appointment?

Our Special Finance Representatives are busy folks, and they meet with lots of people like you on a daily basis. If we didn’t schedule appointments, they wouldn’t be able to work with you one-on-one and give you personal attention.

5. What if I don’t get a car?

We work hard to get our customers into a car, but in the rare scenario that we can’t get you the car you want at the financing you want, we offer complimentary gifts just for making it to your appointment. Ask your Special Finance Representative for details.

6. Why do I have to meet with a Special Finance Representative? Can’t I get approved over the phone?

Without seeing proper documentation and doing a credit check, it is impossible to get approved for a car loan. Anyone that tells you that you are approved for a car loan over the phone is not being honest. Besides that, your financing depends on your credit score, what car you want to get, and other factors that need to be discussed in person.

7. Is there anything else I need to bring to my appointment?

This appointment is as much for you as it is for us, and you will get out of it what you put into it. With Approved Loan Store, you will get great customer service, financing options, and a huge inventory of vehicles, but you will get even more out of it if you come prepared and know the right questions to ask. An inquisitive consumer is a smart consumer, so never be afraid to ask if you don’t understand how much you will be paying, the APR, or how many total payments you will be making.

Still have questions? Feel free to call and speak with one of our Approved Loan Store representatives at 877-217-2217. Are you looking for a new or used vehicle? Fill out our secure online auto loan application here, and check out testimonials from real Approved Loan Store customers here. You can also keep up to date on the latest news from Approved Loan Store by liking us on Facebook and following us on Twitter.

Image: Ambro / FreeDigitalPhotos.net

Earlier this week, we told you how rising airline ticket prices were pushing families to reconsider road trips for their summer vacations. Well, apparently we aren’t the only ones who see the road trip making a come-back.

Earlier this week, we told you how rising airline ticket prices were pushing families to reconsider road trips for their summer vacations. Well, apparently we aren’t the only ones who see the road trip making a come-back.

News for the airline companies of late hasn’t been the best. The headlines have been negative for both the airlines themselves and for their customers. It’s been bankruptcies or charging more for checking luggage or just the introduction of fees just to store your bag in the overhead. Airfares themselves are on the rise. The cost of summer flights in the US are up 3 percent on average from the past year. That’s an 18 percent increase from 2010. It’s starting to be clear that flying is no longer the go-to solution for a cheap vacation.

News for the airline companies of late hasn’t been the best. The headlines have been negative for both the airlines themselves and for their customers. It’s been bankruptcies or charging more for checking luggage or just the introduction of fees just to store your bag in the overhead. Airfares themselves are on the rise. The cost of summer flights in the US are up 3 percent on average from the past year. That’s an 18 percent increase from 2010. It’s starting to be clear that flying is no longer the go-to solution for a cheap vacation. When someone is a first-time car buyer, the whole car shopping experience can seem very exciting. Everything is shiny and new, and it is easy to get caught up in imaging the wind in your hair while forgetting costly details.

When someone is a first-time car buyer, the whole car shopping experience can seem very exciting. Everything is shiny and new, and it is easy to get caught up in imaging the wind in your hair while forgetting costly details. Car shoppers looking to get a new set of wheels are doing more than upgrading their ride. They are improving the economy.

Car shoppers looking to get a new set of wheels are doing more than upgrading their ride. They are improving the economy. With the resurgence of the auto industry being firmly embedded into the news cycle month after month, the major car makers have found themselves questioning just what they have to do to keep themselves there. A recent report from AARP showed that the Millennial generation are the ones with the most buying power. Making up more than 40 percent of the car buying market, there’s been a considerable shift in thinking from the car companies about just who they should be selling their cars to. The youth crowd has been the typical demographic, but with only making up 27 percent of new vehicle sales, it begs the question of just how much effort should be extended to encourage the young to purchase a car?

With the resurgence of the auto industry being firmly embedded into the news cycle month after month, the major car makers have found themselves questioning just what they have to do to keep themselves there. A recent report from AARP showed that the Millennial generation are the ones with the most buying power. Making up more than 40 percent of the car buying market, there’s been a considerable shift in thinking from the car companies about just who they should be selling their cars to. The youth crowd has been the typical demographic, but with only making up 27 percent of new vehicle sales, it begs the question of just how much effort should be extended to encourage the young to purchase a car? In the first quarter of 2012, car sales are still on the rise with used car sales making up a large percentage of those sales, and according to

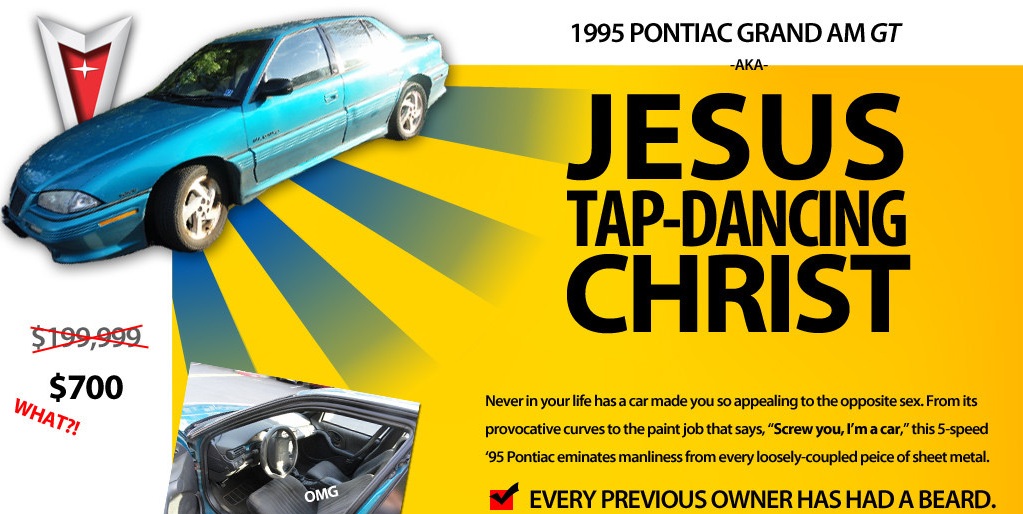

In the first quarter of 2012, car sales are still on the rise with used car sales making up a large percentage of those sales, and according to  What does it take to make a $700 1995 Pontiac Grand Am into one of the most wanted cars on the internet? Simply make the greatest Craigslist ad ever.

What does it take to make a $700 1995 Pontiac Grand Am into one of the most wanted cars on the internet? Simply make the greatest Craigslist ad ever. At Approved Loan Store, we get asked all the time why we can’t give car loan approvals over the phone and why our customers need to bring their driver’s license, Social Security card, proof of income, and other identification to their appointment. Yesterday, there was a perfect

At Approved Loan Store, we get asked all the time why we can’t give car loan approvals over the phone and why our customers need to bring their driver’s license, Social Security card, proof of income, and other identification to their appointment. Yesterday, there was a perfect  At Approved Loan Store, we take the hassle out of car buying. We make the process easy, even if you have challenged credit. Still, we want our customers to understand our process and why we are the best way to get into a new or used car quickly!

At Approved Loan Store, we take the hassle out of car buying. We make the process easy, even if you have challenged credit. Still, we want our customers to understand our process and why we are the best way to get into a new or used car quickly! These days, a lot of companies are promising the world to people with challenged credit who are looking for a way back. One of the fastest ways to re-establish credit is through a car loan, so there is a high demand for car loans from people with challenged credit. Unfortunately, this means that some businesses will take advantage of that demand and take advantage of less-informed consumers. We wanted to clear up some misconceptions and misinformation that is spread about credit restoration and auto loans. If more consumers are educated, then less people will fall prey to these predatory companies.

These days, a lot of companies are promising the world to people with challenged credit who are looking for a way back. One of the fastest ways to re-establish credit is through a car loan, so there is a high demand for car loans from people with challenged credit. Unfortunately, this means that some businesses will take advantage of that demand and take advantage of less-informed consumers. We wanted to clear up some misconceptions and misinformation that is spread about credit restoration and auto loans. If more consumers are educated, then less people will fall prey to these predatory companies.