In the Coen Brothers’ film The Hudsucker Proxy, there is a scene where Noville Barnes, a fresh-faced, ambitious young lad, goes to take a look at the city’s jobs board and makes a terrible discovery. Nearly every job available requires at least five years of business executive job experience, and he has almost no job experience at all. He cannot get a job without experience, and he cannot get job experience without first holding a job.

In the Coen Brothers’ film The Hudsucker Proxy, there is a scene where Noville Barnes, a fresh-faced, ambitious young lad, goes to take a look at the city’s jobs board and makes a terrible discovery. Nearly every job available requires at least five years of business executive job experience, and he has almost no job experience at all. He cannot get a job without experience, and he cannot get job experience without first holding a job.

Establishing credit is a very similar experience. In order to get approved for a credit card or an auto loan, lenders want to see a history of paying credit cards and loans on time, but it is impossible to establish that payment history without first getting a credit card or loan. Consumers with no credit are stuck in a frustrating cycle. If they do somehow get approved for a credit card or loan, they can end up saddled with high interest rates, fall behind on payments, and end up with a poor credit history which is almost as bad as no credit at all.

For these reasons, I had difficulty reading the article “Why You Should Never Co-Sign for Your Kid.” The author takes the definitive stance that parents should “never” co-sign for their children. She seems to take the stance of tough love, saying that no credit is “no big deal.” It might seem like a big deal right now, but there are many circumstances under which a teenager having credit is necessary. I hate to say it, but what if something happened to the parents? What if there was an accident or a long illness and their child had to take on more financial responsibilities for the family? An emergency situation would hardly be the time to try to establish credit.

Even if nothing that drastic occurred, I will want my teenagers to be able to obtain low interest rates by the time they are living on their own. They will already have to deal with high student loan interest rates, and while I personally plan on helping them pay for college, many families can’t afford to do so. Are they supposed to worry about establishing credit when they are already facing a mountain of student loan debt?

I am not saying that it is always a good idea to co-sign a loan with a family member. There are plenty of circumstances where co-signing for a loan is not advised, but I don’t appreciate the author issuing a blanket statement that parents should never co-sign a loan for their child.

Readers, what do you think? Would you co-sign a loan for a family member, or do you think it is a bad idea? Leave a comment below, and let us know what you think!

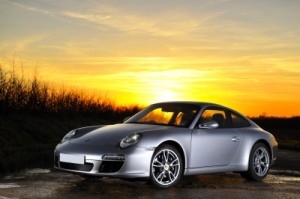

Is your credit keeping you from getting an auto loan? Approved Loan Store wants to help YOU get into a new or used car! Good credit, bad credit, no credit, we will work with you to get a car you want at terms you can afford! Get started today by filling out our secure online auto loan application here, and for more auto news and buying tips, like Approved Loan Store on Facebook, follow Approved Loan Store on Twitter, and subscribe to Approved Loan Store on YouTube!

Image courtesy of photostock / FreeDigitalPhotos.net

Last week, Toyota announced that 3 million Priuses have been sold worldwide.

Last week, Toyota announced that 3 million Priuses have been sold worldwide.