At Approved Loan Store, we take the hassle out of car buying. We make the process easy, even if you have challenged credit. Still, we want our customers to understand our process and why we are the best way to get into a new or used car quickly!

At Approved Loan Store, we take the hassle out of car buying. We make the process easy, even if you have challenged credit. Still, we want our customers to understand our process and why we are the best way to get into a new or used car quickly!

The first step is filling out our convenient and secure online auto loan application here. Once you fill it out, you will hear back from one of our friendly Approved Loan Store representatives within 24 to 48 hours. They will verify the information on your application and let you know if you are picked for our loan program. If you are chosen, you will be scheduled to meet with an Approved Loan Store Special Finance Representative to look at vehicles and discuss your financing options.

Now, we get more questions about the meeting with a Special Finance Representative than any other part of the process, so we wanted to answer some of the more frequently asked questions here.

1. What do I need to bring with me to the appointment?

Bring your driver’s license, Social Security Card, a proof of residence, and proof of your income. Proof of residence can be a utility bill or bank statement that has your current address on it. For proof of income, bring two recent pay stubs or a letter from your employer stating how much you make and whether you are paid weekly or bi-weekly.

2. Do I need to buy a car if I set up an appointment?

Absolutely not! Approved Loan Store will work very hard to put together the best deal for you, but you are not obligated to purchase a vehicle if you meet with a Special Finance Representative.

3. Approved Loan Store set me up with Special Finance Representative located at a Kia/Chrysler/Mazda dealership, but I want a different brand of car. What do I do?

No worries! Your Special Finance Representative might be located at one dealership, but they can pull cars from any of Approved Loan Store’s certified locations. You are not limited by brand make or model. Tell your Special Finance Representative what car you are looking for, and they will do their best to get you that car! Remember, any make, any model!

4. Why do I need to set up an appointment?

Our Special Finance Representatives are busy folks, and they meet with lots of people like you on a daily basis. If we didn’t schedule appointments, they wouldn’t be able to work with you one-on-one and give you personal attention.

5. What if I don’t get a car?

We work hard to get our customers into a car, but in the rare scenario that we can’t get you the car you want at the financing you want, we offer complimentary gifts just for making it to your appointment. Ask your Special Finance Representative for details.

6. Why do I have to meet with a Special Finance Representative? Can’t I get approved over the phone?

Without seeing proper documentation and doing a credit check, it is impossible to get approved for a car loan. Anyone that tells you that you are approved for a car loan over the phone is not being honest. Besides that, your financing depends on your credit score, what car you want to get, and other factors that need to be discussed in person.

7. Is there anything else I need to bring to my appointment?

This appointment is as much for you as it is for us, and you will get out of it what you put into it. With Approved Loan Store, you will get great customer service, financing options, and a huge inventory of vehicles, but you will get even more out of it if you come prepared and know the right questions to ask. An inquisitive consumer is a smart consumer, so never be afraid to ask if you don’t understand how much you will be paying, the APR, or how many total payments you will be making.

Still have questions? Feel free to call and speak with one of our Approved Loan Store representatives at 877-217-2217. Are you looking for a new or used vehicle? Fill out our secure online auto loan application here, and check out testimonials from real Approved Loan Store customers here. You can also keep up to date on the latest news from Approved Loan Store by liking us on Facebook and following us on Twitter.

Image: Ambro / FreeDigitalPhotos.net

After years of searching Edmunds, Consumer Reports, and MSN Autos for the best cars on the market, consumers can now get the most relevant vehicle reviews all in one place.

After years of searching Edmunds, Consumer Reports, and MSN Autos for the best cars on the market, consumers can now get the most relevant vehicle reviews all in one place.

In the first quarter of 2012, car sales are still on the rise with used car sales making up a large percentage of those sales, and according to

In the first quarter of 2012, car sales are still on the rise with used car sales making up a large percentage of those sales, and according to  The rise of gas prices have lead car drivers to start making more educated choices in their choices. Hybrids are really seeing a surge in sales due to people looking to keep away from those high prices as much as possible. That popularity is causing many buyers to ask the question, should I buy a hybrid?

The rise of gas prices have lead car drivers to start making more educated choices in their choices. Hybrids are really seeing a surge in sales due to people looking to keep away from those high prices as much as possible. That popularity is causing many buyers to ask the question, should I buy a hybrid?  The price might be right for cars on Craigslist, but car buyers could be putting themselves at risk for hidden problems like missing airbags.

The price might be right for cars on Craigslist, but car buyers could be putting themselves at risk for hidden problems like missing airbags. If you want your car to be more fuel-efficient,

If you want your car to be more fuel-efficient,  So far, 2012 is a year full of auto innovations from the rotary shifter to the

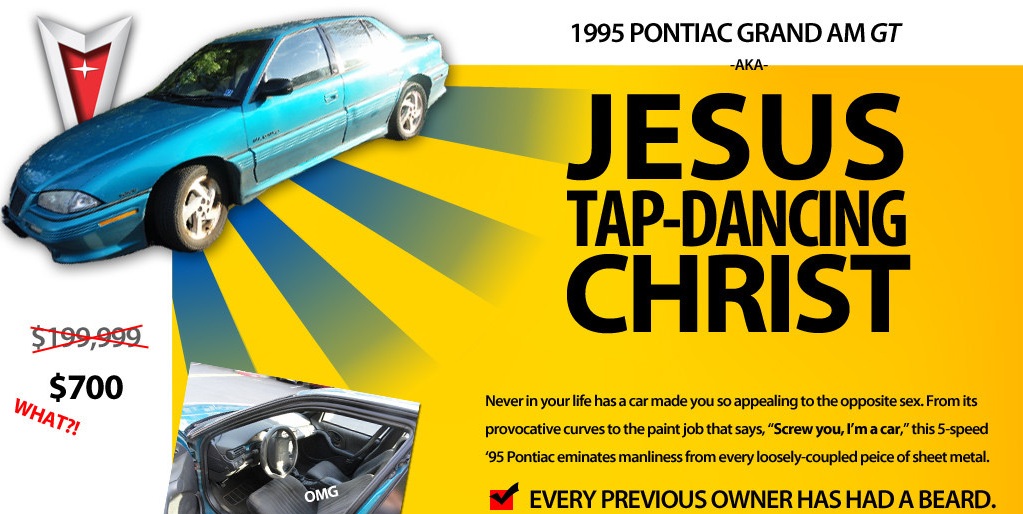

So far, 2012 is a year full of auto innovations from the rotary shifter to the  What does it take to make a $700 1995 Pontiac Grand Am into one of the most wanted cars on the internet? Simply make the greatest Craigslist ad ever.

What does it take to make a $700 1995 Pontiac Grand Am into one of the most wanted cars on the internet? Simply make the greatest Craigslist ad ever. The Consumer Financial Protection Bureau is still getting its feet wet seeing as how the President just assigned Richard Cordray to the agency a few months ago. That doesn’t mean they don’t want to hit the ground running, though.

The Consumer Financial Protection Bureau is still getting its feet wet seeing as how the President just assigned Richard Cordray to the agency a few months ago. That doesn’t mean they don’t want to hit the ground running, though. At Approved Loan Store, we get asked all the time why we can’t give car loan approvals over the phone and why our customers need to bring their driver’s license, Social Security card, proof of income, and other identification to their appointment. Yesterday, there was a perfect

At Approved Loan Store, we get asked all the time why we can’t give car loan approvals over the phone and why our customers need to bring their driver’s license, Social Security card, proof of income, and other identification to their appointment. Yesterday, there was a perfect  At Approved Loan Store, we take the hassle out of car buying. We make the process easy, even if you have challenged credit. Still, we want our customers to understand our process and why we are the best way to get into a new or used car quickly!

At Approved Loan Store, we take the hassle out of car buying. We make the process easy, even if you have challenged credit. Still, we want our customers to understand our process and why we are the best way to get into a new or used car quickly!