With the resurgence of the auto industry being firmly embedded into the news cycle month after month, the major car makers have found themselves questioning just what they have to do to keep themselves there. A recent report from AARP showed that the Millennial generation are the ones with the most buying power. Making up more than 40 percent of the car buying market, there’s been a considerable shift in thinking from the car companies about just who they should be selling their cars to. The youth crowd has been the typical demographic, but with only making up 27 percent of new vehicle sales, it begs the question of just how much effort should be extended to encourage the young to purchase a car?

With the resurgence of the auto industry being firmly embedded into the news cycle month after month, the major car makers have found themselves questioning just what they have to do to keep themselves there. A recent report from AARP showed that the Millennial generation are the ones with the most buying power. Making up more than 40 percent of the car buying market, there’s been a considerable shift in thinking from the car companies about just who they should be selling their cars to. The youth crowd has been the typical demographic, but with only making up 27 percent of new vehicle sales, it begs the question of just how much effort should be extended to encourage the young to purchase a car?

Autofinancenews.net has an article that shows that the advent of social media has diminished the desire for many youths to own a car. Why do they need to purchase a new set of wheels to go visit a friend when they’re are just a tweet/text/email away? Many are still in college, struggling with staggering college debt, and are turned off when looking at just the costs of gas and concerns about the environment.

Car makers, like GM and Chevy, are trying to see what they can get in the $170 billion in buying power young consumers have. They have teamed up with MTVScratch, to see how to get both the youth and the Millennial into dealerships. One of the first orders of business is rethinking business. MTVScratch will be transforming not just the way cars look, or the technology in the dashboard, but will even be re-imaging the test drive. Chevy, for example, will have their upcoming models of the Sonic, Cruze, and Spark available in some news colors, such as “techno pink,” “lemonade,” and “denim.” Scratch has even gone as far as saying that the sales people at the dealerships need to abandon the commission system. The new buying crowd is used to buying things like in an Apple Store, where the employees don’t use hard sell tactics.

It’s still the question of if the young buyers are going to be the ones to really help the auto industry’s sales trend. Jeep has decided the answer is no and have turned to the Millennials by taking out ads in AARP’s magazine geared strictly at placing the above 50 crowd into a new car. Only time will tell of just how auto makers can succeed in capturing such a large part of the market and just which generation is the one to keep the industry strong.

What do you think? Which market is the better one, the youth or the over 50 generation? Go ahead and leave a comment voicing your opinion. If you’re part of either group and looking to purchase a vehicle, but suffer from challenged credit, be sure to fill out an application for Approved Loan Store. Our staff is waiting to help get you into the car you want. Like us on Facebook and follow us on Twitter and we’ll keep you up to date on all the latest news in the industry.

Earlier this week, we showed why buying a used car is smarter than buying new. The value of a new car will depreciate very quickly only a few years after buying it, so the owner will get a better return on a used car vs. a new car if they eventually have to trade it in. As it turns out, Forbes is talking about the new vs. used car debate as well. A few days after we published

Earlier this week, we showed why buying a used car is smarter than buying new. The value of a new car will depreciate very quickly only a few years after buying it, so the owner will get a better return on a used car vs. a new car if they eventually have to trade it in. As it turns out, Forbes is talking about the new vs. used car debate as well. A few days after we published  After years of searching Edmunds, Consumer Reports, and MSN Autos for the best cars on the market, consumers can now get the most relevant vehicle reviews all in one place.

After years of searching Edmunds, Consumer Reports, and MSN Autos for the best cars on the market, consumers can now get the most relevant vehicle reviews all in one place. In the first quarter of 2012, car sales are still on the rise with used car sales making up a large percentage of those sales, and according to

In the first quarter of 2012, car sales are still on the rise with used car sales making up a large percentage of those sales, and according to  The price might be right for cars on Craigslist, but car buyers could be putting themselves at risk for hidden problems like missing airbags.

The price might be right for cars on Craigslist, but car buyers could be putting themselves at risk for hidden problems like missing airbags. If you want your car to be more fuel-efficient,

If you want your car to be more fuel-efficient,  So far, 2012 is a year full of auto innovations from the rotary shifter to the

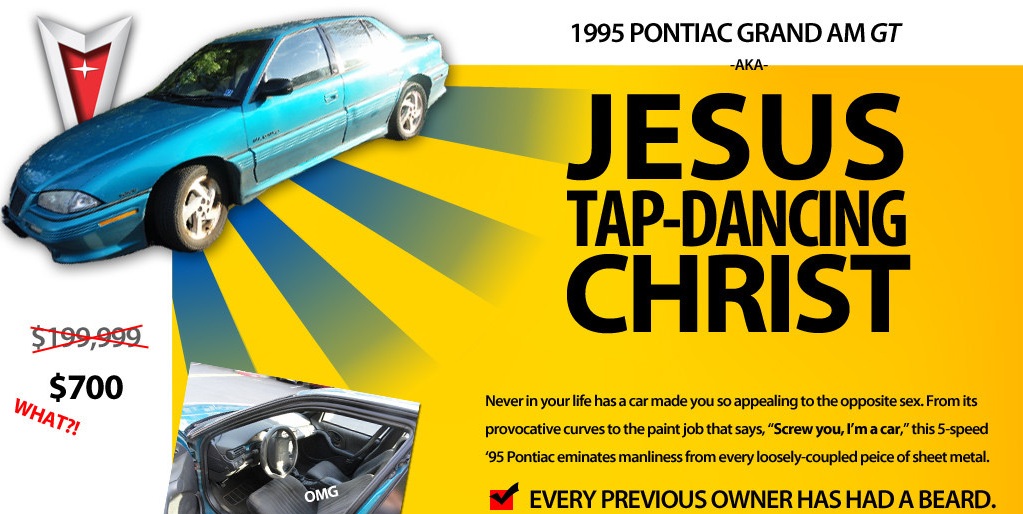

So far, 2012 is a year full of auto innovations from the rotary shifter to the  What does it take to make a $700 1995 Pontiac Grand Am into one of the most wanted cars on the internet? Simply make the greatest Craigslist ad ever.

What does it take to make a $700 1995 Pontiac Grand Am into one of the most wanted cars on the internet? Simply make the greatest Craigslist ad ever. The Consumer Financial Protection Bureau is still getting its feet wet seeing as how the President just assigned Richard Cordray to the agency a few months ago. That doesn’t mean they don’t want to hit the ground running, though.

The Consumer Financial Protection Bureau is still getting its feet wet seeing as how the President just assigned Richard Cordray to the agency a few months ago. That doesn’t mean they don’t want to hit the ground running, though. At Approved Loan Store, we get asked all the time why we can’t give car loan approvals over the phone and why our customers need to bring their driver’s license, Social Security card, proof of income, and other identification to their appointment. Yesterday, there was a perfect

At Approved Loan Store, we get asked all the time why we can’t give car loan approvals over the phone and why our customers need to bring their driver’s license, Social Security card, proof of income, and other identification to their appointment. Yesterday, there was a perfect